How Openpay works

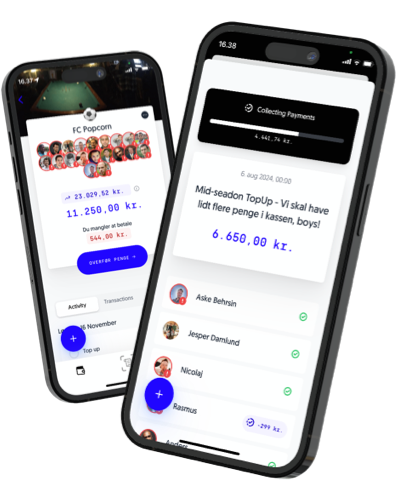

Openpay makes it easy and clear to share money as a group. Whether it's for food, subscriptions, or a joint account for your group, you can manage everything directly from the app.

Openpay makes it easy and clear to share money as a group. Whether it's for food, subscriptions, or a joint account for your group, you can manage everything directly from the app.

Start by creating a joint account for your group.

The app gives you full transparency over your shared finances.

When the account needs to be topped up, Openpay makes it simple and efficient:

Get a payment card directly linked to your joint account:

Openpay makes it easy to share expenses when someone pays upfront:

Start by creating a joint account for your group.

The app gives you full transparency over your shared finances.

When the account needs to be topped up, Openpay makes it simple and efficient:

Get a payment card directly linked to your joint account:

Openpay makes it easy to share expenses when someone pays upfront: